-

Actlogica

Platform to help accelerate financial inclusion in India by providing scalable tech infrastructure to wealth managers and investment professionals.

-

AssetPlus

Platform offering solutions to financial advisors and mutual fund distributors to streamline the processes of investing in mutual funds through multi-portfolio support, unbiased research, and digital marketing.

-

Blostem

Blostem builds the software that lets other apps offer fixed deposits from multiple banks easily, without dealing with complex bank systems themselves.

-

Capitalmind

Capitalmind AMC offers data-driven investment strategies geared to build long-term wealth.

-

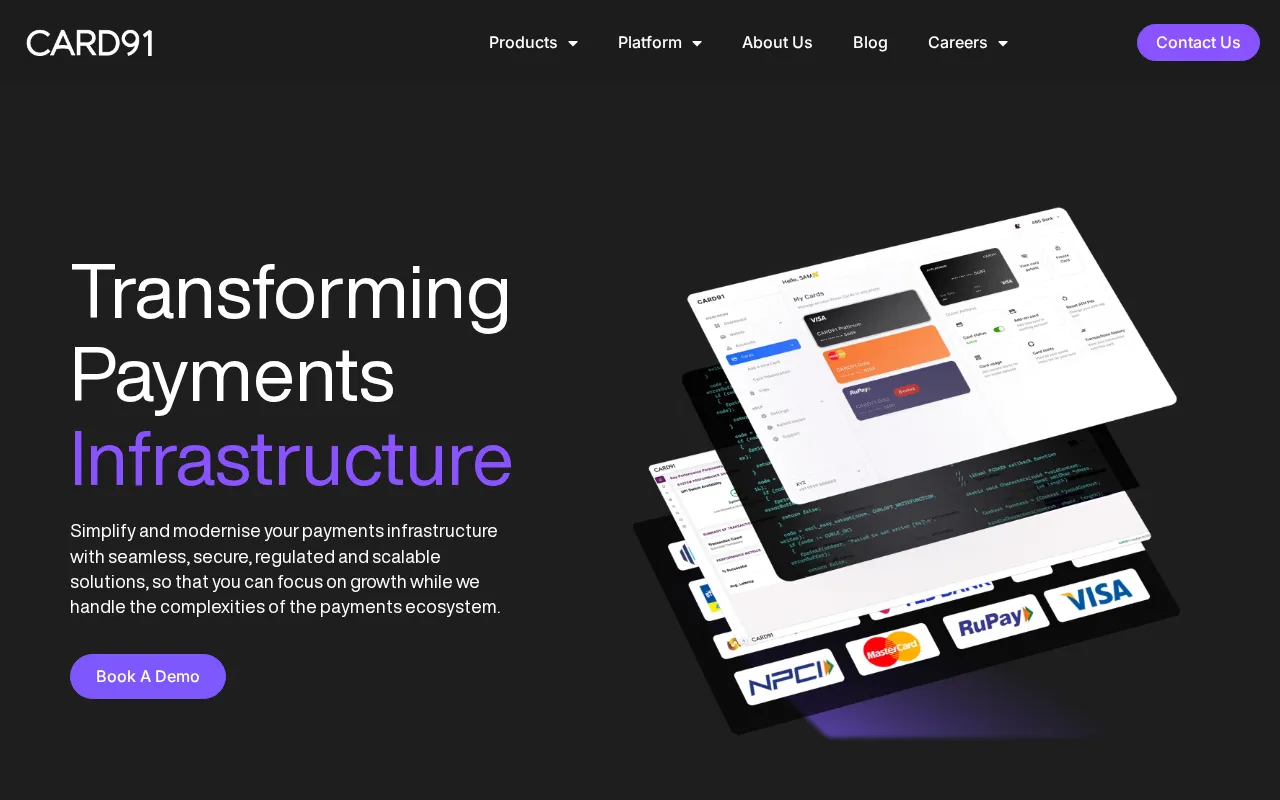

Card91

Solves for Corporate Cards and acts as an end-to-end card solution for company expenses, food, travel, insurance, investments, and other such miscellaneous expenses. Allows any entity/organisation/closed group to issue cards to their target audience, allowing them to maintain all controls with respect to how the card would work.

-

Castler

Castler makes escrow services more accessible and convenient for enterprises and consumers by digitising the escrow process. They try to eliminate fraud and make business transactions safer.

-

Cred

CRED is a members-only app that offers you exclusive rewards for paying your credit card bills. It also offers UPI, account aggregator and car-related services.

-

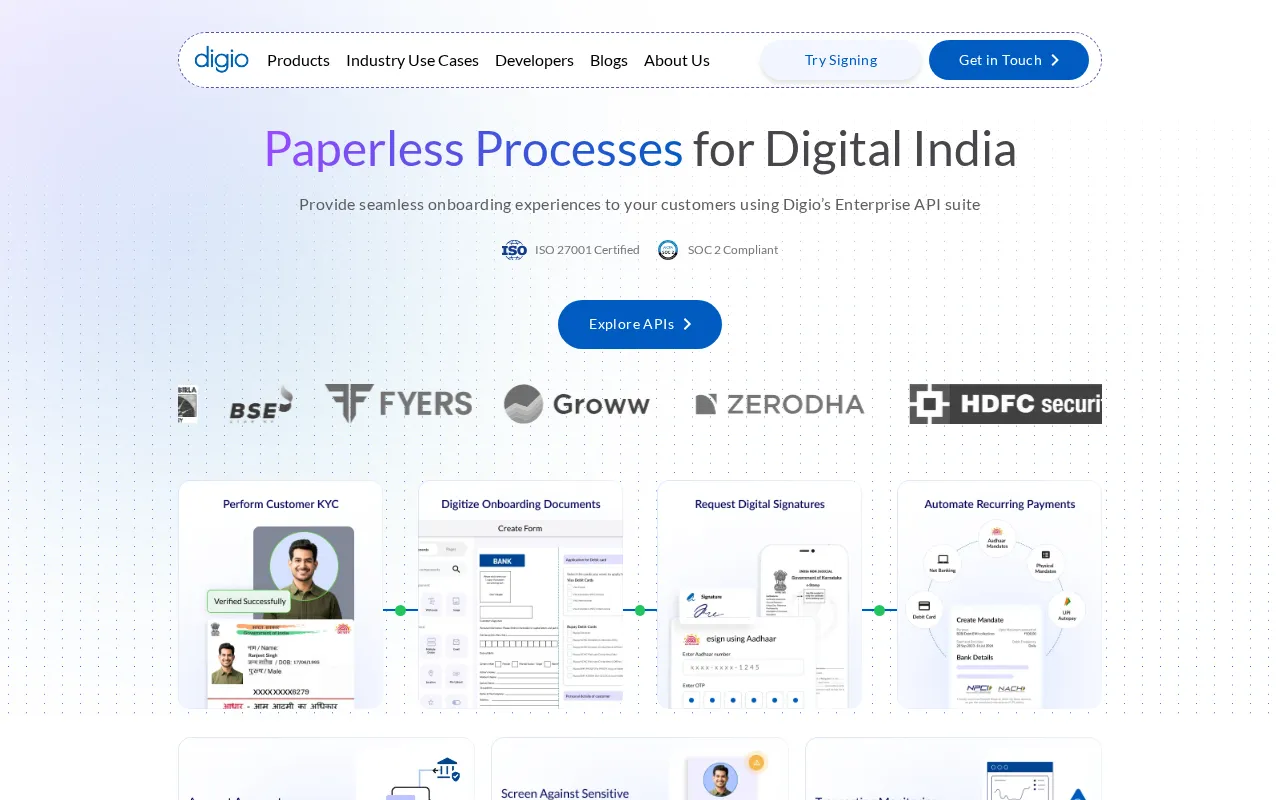

Digio

Digio is driving India’s digital transformation - by bringing paperless, hassle-free documentation and digital processes to Indian businesses and consumers.

-

Epifi

Digital banking experience that aims to update the way we bank and simplify money for the Indian millennial.

-

Goalteller

A personal finance platform that empowers investors to invest better, secure their family against life's uncertainties and achieve their aspirations regarding long term money objectives.

-

Hissa

Hissa is a legal and fintech startup that enables private companies to digitize and securely manage their equity holdings and fundraising transactions.

-

Indiadatahub

IndiaDataHub is building India’s largest market data and analytics platform; helping students, analysts, investors, and policy makers with economic data.

-

Indus

Indus builds the bridge connecting global retail investors to India's financial markets. Invest without an Indian bank account or documents, deposit and withdraw instantly from your local bank, with Indian tax and compliance fully automated. Access the world's fastest-growing economy, seamlessly and securely.

-

Jodo

Jodo aims to serve the middle income households in urban India with innovative financial products and services. Their first product is in school fee finance, in which they enable parents to pay fees monthly at no interest.

-

Jupiter

Home-grown and co-created with a community of users, Jupiter is a digital banking experience that aims to update the way we bank and simplify money for the Indian millennial.

-

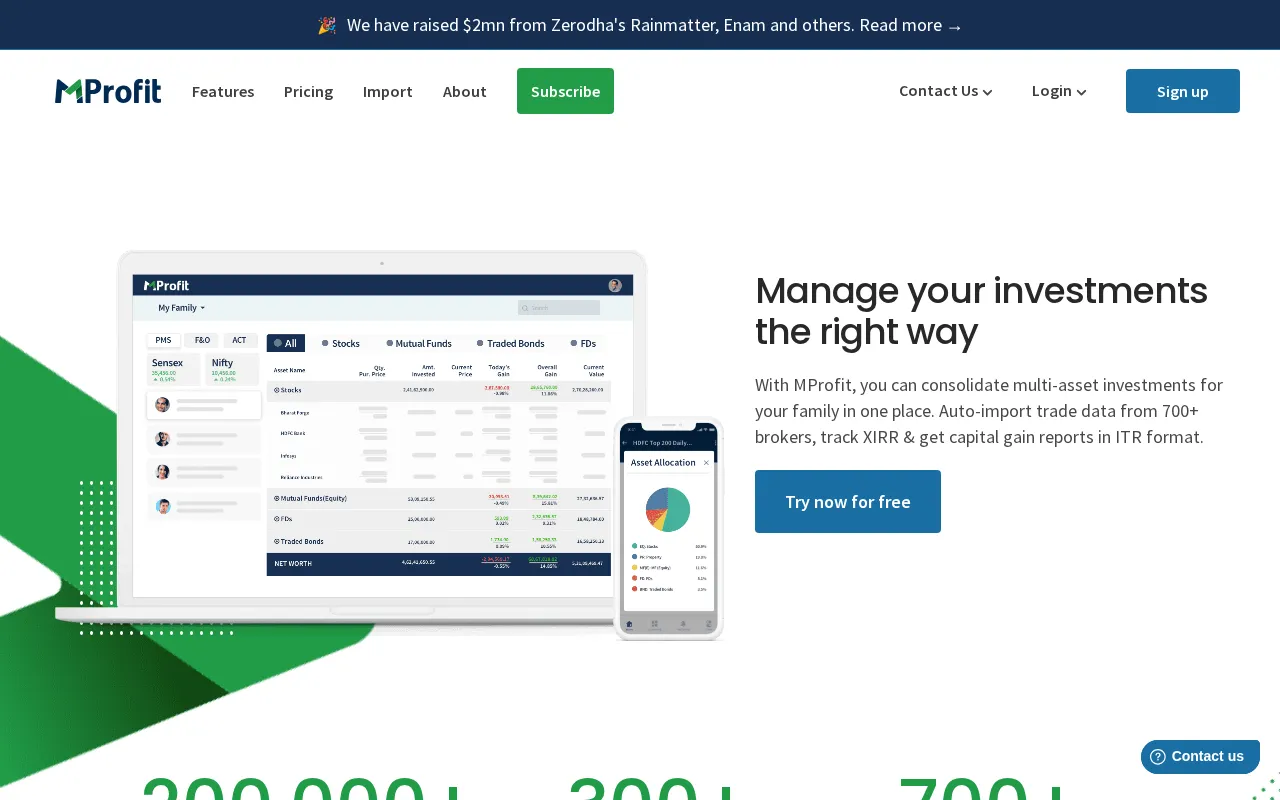

Mprofit

MProfit helps seamlessly track all investments in one place, eliminating the need for spreadsheets that investors rely on for manual data entry and analysis.

-

NullPointer

Nullpointer is a financial data insights platform that helps with predictive credit default models & PDF data extraction tools to structure unstructured data.

-

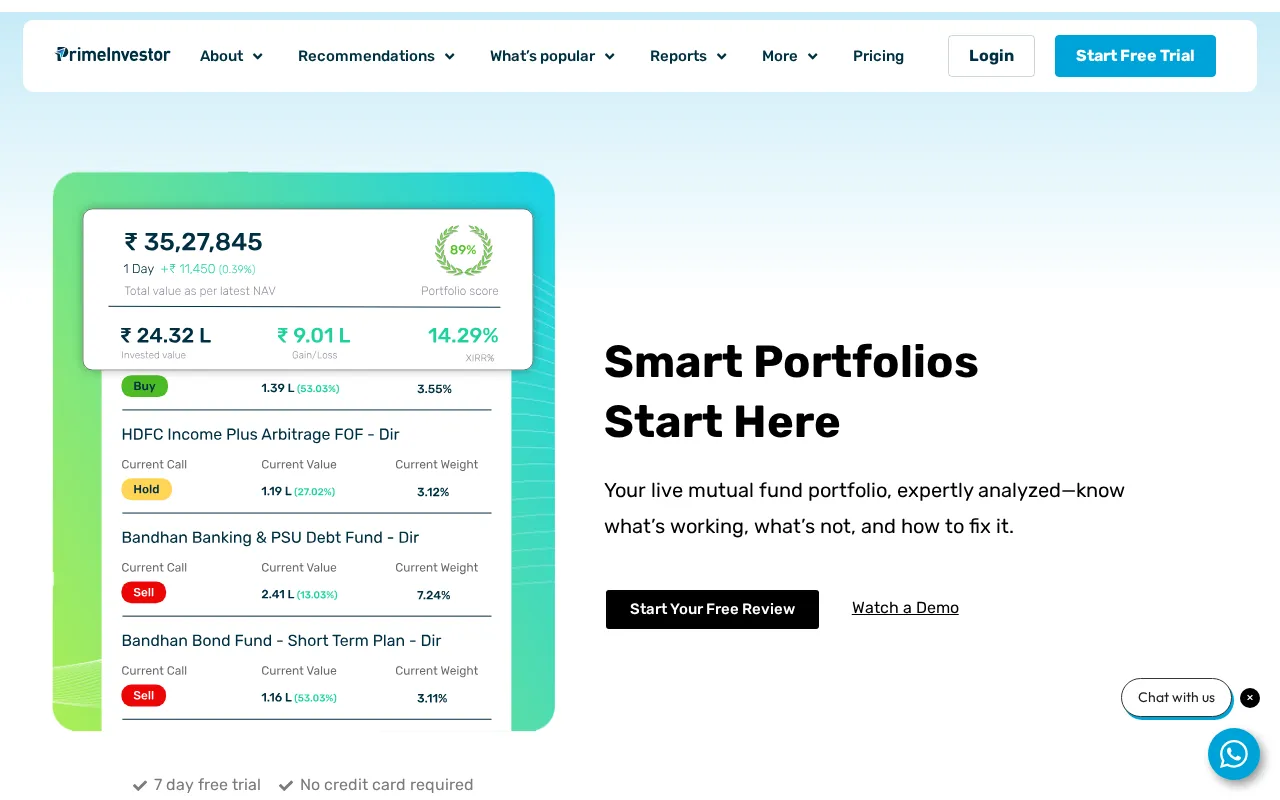

Prime Investor

Research-driven investment platform offering expert recommendations and curated portfolios.

-

Procol

Procol offers smart procurement software that helps companies take control of their procurement operations with efficiency and transparency.

-

Quicko

A platform to help plan, prepare and file your Income Taxes, GST & TDS returns online. Quicko also has a host of APIs for businesses to compute and file GST, TDS and Payroll taxes

-

Sensibull

An options trading platform, Sensibull is trying to make options trading safer, more accessible and build an education ecosystem around it.

-

The Financialist

A registered investment advisor platform that helps individuals manage all parts of their personal finance - insurance, taxes, investments and loans.

-

ValuEnable

A platform that helps clients continue receiving the benefits of their life insurance policies by allowing them to take a loan against the surrender value, or assign the policy to another person in times of need. Valuenable also works directly with Insurance companies to educate clients on why they need to continue with their insurance policies.

-

Wint wealth

Platform for businesses to raise retail debt & allow retail investors to invest into listed debt securities and other fixed income opportunities.